Analysis of the main factors affecting the trend of RMB exchange rate Analysis of the main factors affecting the trend of the RMB exchange rate 1. First of all, we must unders...

Analysis of the main factors affecting the trend of RMB exchange rate

Analysis of the main factors affecting the trend of the RMB exchange rate

1. First of all, we must understand the exchange rate system currently implemented in China. The exchange rate system currently implemented in China is: based on market supply and demand, adjusted with reference to a basket of currencies, and governed floating exchange rate system.

–Market supply and demand conditions

–Adjustment with reference to a basket of currencies: “reference” rather than pegged, it can be 100% reference, that is, pegged, or it can be 0 reference, that is, independent decision-making; the U.S. dollar index can be used as a A reference to a basket of currencies.

–Is there any control: Will it be managed?

Since the exchange rate of RMB against the US dollar is the basic exchange rate, the exchange rates of RMB against other foreign currencies are calculated through the exchange rates of other currencies and the US dollar (despite the official claim that the RMB against Japan Yuan has achieved direct exchange), so China’s exchange rate system also mainly reflects the arrangement of the exchange rate of RMB against the US dollar

The current Chinese foreign exchange market: especially the inter-bank foreign exchange market, still lacks depth and breadth, and is an extremely immature market. In the foreign exchange market, market expectations are simply one-sided. If you want to be bullish, everyone is bullish, and if you want to be bearish, everyone is bearish. Therefore, everyone wants to buy, and everyone wants to sell.

2. Opening middle parity and intraday trading price

Opening middle parity:

According to the introduction of the China Foreign Exchange Trading Center:

–The central parity rate of the RMB to U.S. dollar exchange rate is formed as follows: The trading center Before the opening of the inter-bank foreign exchange market every day, inquire the foreign exchange market makers for prices, and use all market makers’ quotes as the calculation sample for the central parity rate of the RMB against the U.S. dollar. After removing the high and low quotes, the remaining market makers’ quotes are weighted average. , the central parity rate of the RMB against the US dollar is obtained on the day, and the weight is comprehensively determined by the trading center based on the quotation party’s trading volume and quotation status in the inter-bank foreign exchange market.

–The central parity rate of the RMB against the euro, pound, Hong Kong dollar, Australian dollar and Canadian dollar is determined by the trading center based on the day’s central parity rate of the RMB against the US dollar and the international foreign exchange market euro, pound, Hong Kong dollar and Australian dollar at 9 a.m. Calculated with the Canadian dollar to US dollar exchange rate.

–The central parity rate of the RMB against the Japanese yen, Malaysian ringgit, and Russian ruble is formed by: the trading center consults the market maker of the corresponding currency in the interbank foreign exchange market before the daily opening of the interbank foreign exchange market. Price, average the quotes from market makers, and get the central parity rate of the RMB against the Japanese yen, the Malaysian ringgit, and the Russian ruble on that day.

Among them, the important thing is the opening central parity rate of RMB against the US dollar. Under normal circumstances, the above method is used to determine the opening mid-price, but under extraordinary circumstances…

Intraday trading price: The intraday trading price of RMB against the US dollar fluctuates up and down by 1% relative to the opening mid-price.

——The difference between this price limit and the price limit of the stock market.

3. Main factors affecting the RMB exchange rate (against the US dollar)

China’s trade balance–basic influencing factors

In 2012, China’s trade surplus in goods was US$231.1 billion, an increase from the previous year Nearly 50%, a new high since 2009. In the first five months of this year, the trade surplus was US$80.87 billion. In the same period last year, the surplus was US$37.91 billion.

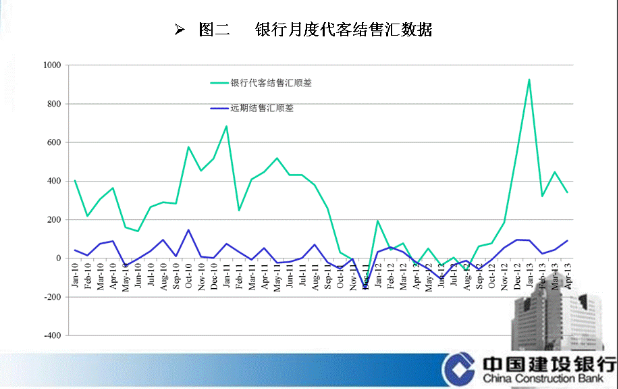

Banks’ foreign exchange settlement and sales on behalf of customers: In January this year, there was a surplus of US$92.6 billion in foreign exchange settlement and sales, a record high. From January to April 2013, the cumulative net foreign exchange settlement and sales by banks on behalf of customers was US$203.6 billion; during the same period, the cumulative net forward foreign exchange settlement by banks on behalf of customers was US$25.5 billion.

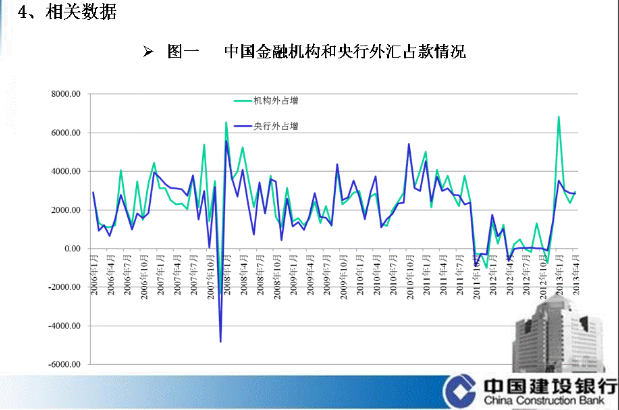

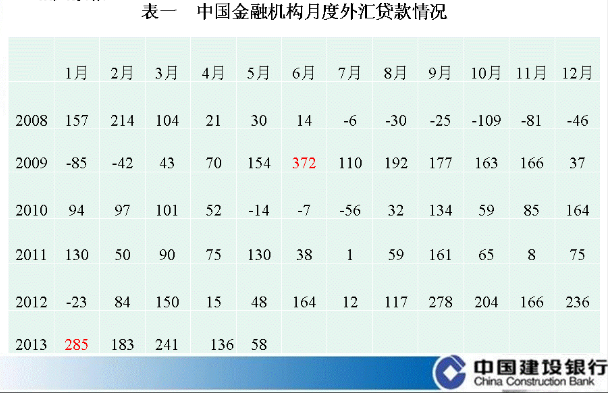

Foreign exchange accounts held by financial institutions: In January this year, there was an increase of 683.659 billion yuan, a record high; in the first four months, the cumulative new foreign exchange accounts held were 1,509.7 billion yuan, and the total foreign exchange accounts held by historical banks were 1,227.7 billion yuan. For the whole of last year, they were 494.7 billion yuan and D428.1 billion respectively.

China’s international balance of payments – online items

In 2012, the current account surplus and the capital account deficit coexisted, and an online balance was basically achieved, reversing the previous double surplus. However, this balance is still relatively fragile and cannot be In fact, is it fundamental to return to a dual-surplus pattern from the first quarter of this year, with a current account surplus of US$55.2 billion and a capital account surplus of US$101.8 billion.

China’s political factors

The attitude of the new Chinese government and Governor Shi towards the RMB exchange rate: they pay more attention to the transformation of economic growth mode and the quality and efficiency of economic growth.

U.S. Economic Situation

On February 12, Obama delivered his second-term State of the Union address, stimulating the economy becoming a top priority. In early 2012, Obama proposed “re-industrialization” and “export doubling plan.” The State of the Union address proposed: and focused on economic growth, it launched a series of measures such as creating new manufacturing innovation institutions and energy security funds, investing in infrastructure construction, strengthening education, raising low wage standards, and starting negotiations on a free trade agreement with the EU.

Affected by the increase in imports and the decline in exports, the U.S. trade deficit increased to US$44.4 billion in January this year, and the revised deficit in December last year was US$38.1 billion; among which, the trade deficit with China in January was ��27.8 billion, up from a revised $2.45 billion the previous month.

International Political Factors

Recently, a well-known American think tank, the Peterson Institute for International Economics, released a research report stating that foreign manipulation of exchange rates has reduced the number of jobs in the United States by 1 million to 5 million over the past few years. , the biggest “sinner” is China. Almost at the same time, Edward Lazier, the former chairman of the US President’s Council of Economic Advisers and a professor at Stanford University, said on the 8th that looking for scapegoats for domestic economic policy difficulties is a common practice among some Americans. Americans blame China’s massive trade deficit and slow job growth on China’s manipulation of its currency to gain an export advantage, a view that has proven untenable.

From the United States, Obama’s main task is to implement the export doubling plan and reindustrialization to promote employment and economic growth.

Sudden factors

AAASDFWERTEYRHF

Extendedreading:https://www.tpu-ptfe.com/post/3295.html

Extendedreading:

Extendedreading:

Extendedreading:

Extendedreading:

Extendedreading:

Extendedreading:

Extendedreading:

Extendedreading:

Extendedread